Star ratings serve as a critical evaluation tool for healthcare payers and providers, significantly impacting both their reputation and financial standing.

Developed by the Centers for Medicare and Medicaid Services (CMS), the Star Ratings system assigns grades to Medicare Advantage (MA) plans, ranging from 1 to 5, with 5 indicating the highest quality. These annual ratings consider multiple factors such as health outcomes, patient experience, and access to care, providing a comprehensive assessment of plan quality.

As these ratings directly influence reimbursement from CMS, they play a pivotal role in shaping the financial landscape of healthcare organizations.

In this blog, we will get into the reasons why star ratings hold such importance in the financial world of the healthcare industry.

Why Star Ratings Matter

Star ratings to measure the quality of health and drug services provided by Medicare plans. The star ratings assigned by CMS are not merely indicators of healthcare quality but carry significant financial implications.

For healthcare providers, achieving high star ratings leads to increased reimbursement and market competitiveness. Insurers, on the other hand, benefit from financial bonuses and improved risk adjustment, positively impacting overall profitability.

Financial Impact on Healthcare Providers

Reimbursement Incentives

- Higher star ratings lead to financial incentives for healthcare providers.

- CMS offers bonus payments to Medicare Advantage (MA) plans based on their star ratings.

- Plans achieving 4 stars or higher are eligible for quality bonus payments, providing a direct financial reward for delivering high-quality care.

Market Competitiveness

- Star ratings influence consumer choices.

- Plans with higher ratings are more attractive to beneficiaries, leading to increased enrollment.

- Higher enrollment not only brings additional revenue but also enhances a provider's competitive position in the market.

Financial Impact on Insurers

Financial Bonuses

- Medicare Advantage (MA) and Part D plans attaining superior star ratings are eligible for significant financial bonuses.

- The financial impact of star ratings is substantial, differentiating between a 3-star and a 4-star plan, translating into millions of dollars.

- The loss of a star is a significant setback for insurers, with plans dropping from 5 or 4 ½ stars to 4 stars experiencing a 5% decrease in bonus payout.

- The bonus rebate remains consistent for both 5-star and 4 ½-star plans, contributing to the financial stability of insurers achieving at least 4 stars.

- These bonus funds are strategically allocated to plan enhancements, further incentivizing enrollment and contributing to the overall financial health of the organization.

Risk Adjustment and Profitability

- Star ratings influence risk adjustment methodologies, impacting reimbursement rates.

- Plans with higher ratings often receive more favorable risk scores, affecting the overall profitability of insurers.

Market Advantage of 5-Star Plans

- Consumers hold the unique ability to switch their existing Medicare Advantage (MA) plan to a 5-star rated insurer at any time, offering a significant advantage to 5-star plans.

- This flexibility allows them to market and attract consumers throughout the year, as opposed to the restricted enrollment period during open enrollment.

- This strategic advantage enhances the marketing and enrollment opportunities for 5-star plans, potentially leading to increased market share.

As the healthcare landscape continues to prioritize quality and value-based care, star ratings emerge as a critical factor in shaping the financial success of both providers and insurers.

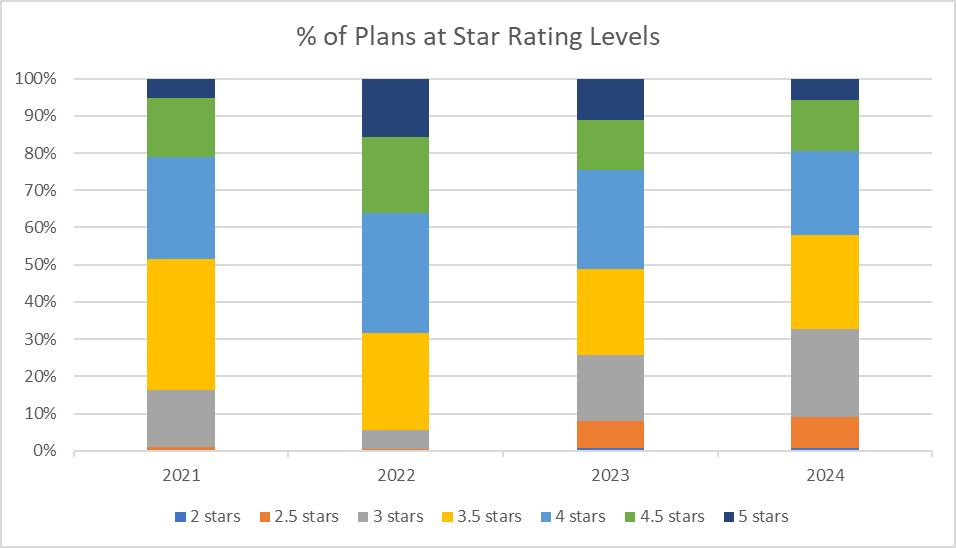

Chart 1: Part C Plans Distribution of Star Ratings Over Time

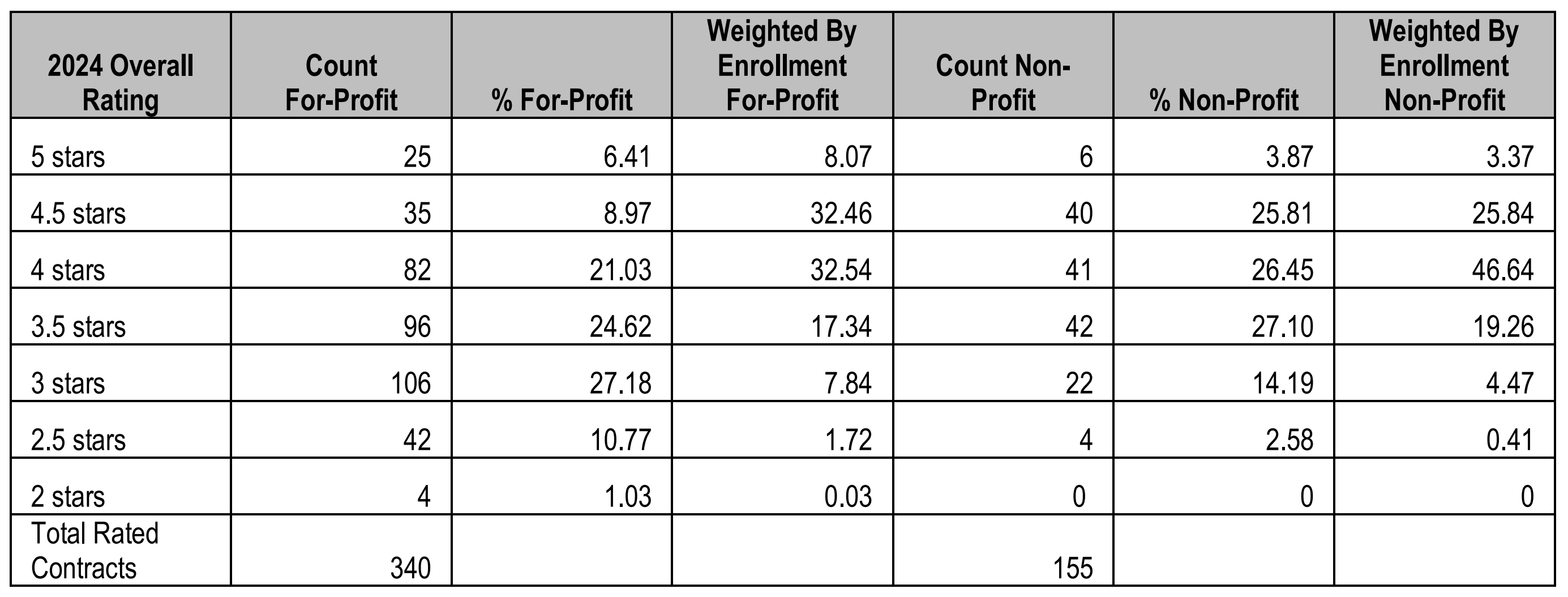

Table 1: Distribution of 2024 Overall Star Ratings for For-Profit and Non-Profit MA-PDs

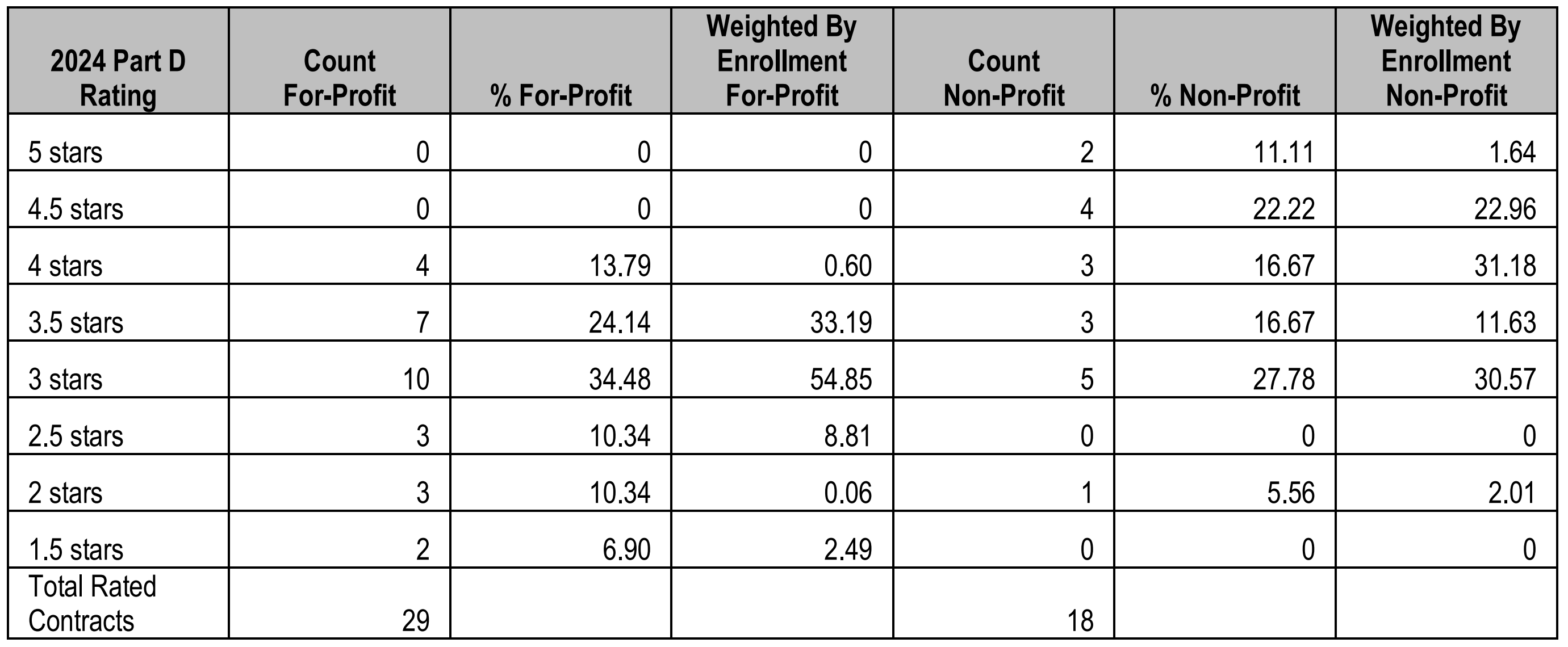

Table 2: Distribution of 2024 Part D Ratings for For-Profit and Non-Profit PDPs

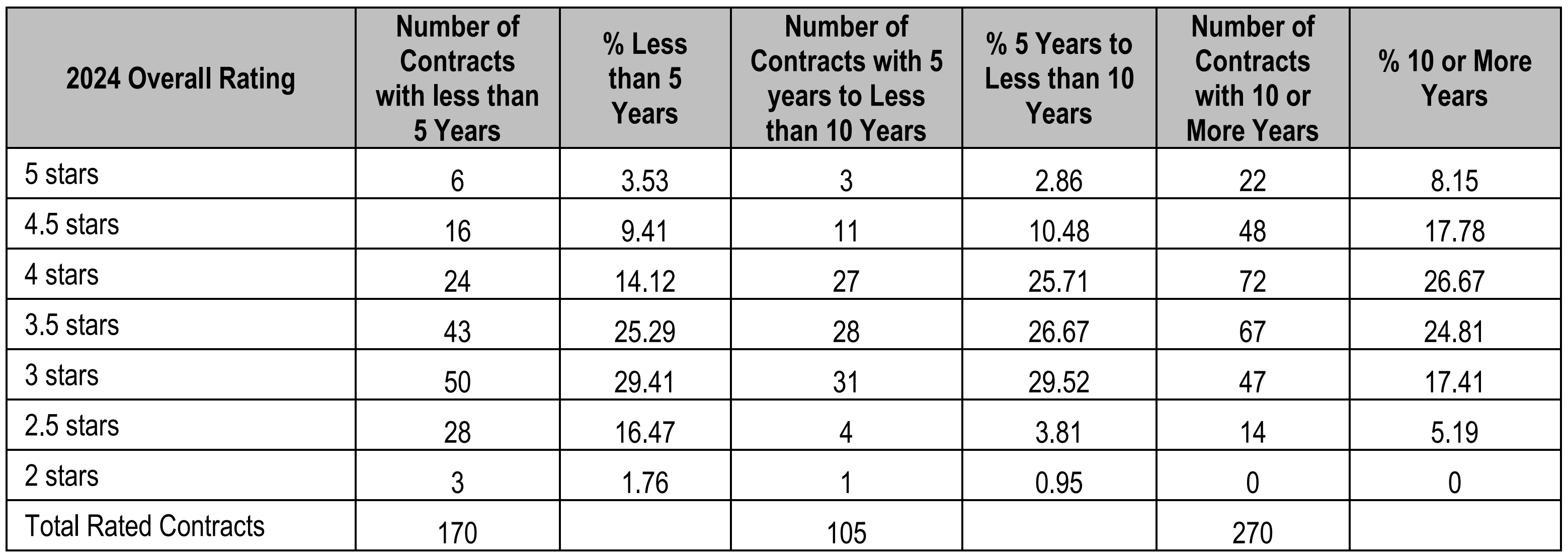

Table 3: Distribution of 2024 Overall Star Ratings by Length of TIme in Program for MA-PDs

Relevant News

Elevance nabs $190M in Medicare Advantage star ratings revision

(Modern Healthcare, March 5, 2024)

In 2023, CMS took decisive actions to strengthen star ratings criteria following a surge in scores, leading to a reduction in the number of Medicare Advantage plans eligible for bonuses. Elevance Health and its regional affiliates filed a lawsuit against the federal government in December 2023, urging CMS to reverse technical adjustments to the star ratings system, recalculate scores, and reassess quality bonus payments.

In a significant development in March 2024, CMS agreed to reevaluate Elevance's contract ratings, resulting in an additional $190 million bonus payout for the organization.

Factors Affecting Star Ratings

Several factors contribute to the coveted star ratings, each playing a distinct role in shaping the overall assessment of a healthcare provider. Patient experience, clinical outcomes, and other key elements are the building blocks of these ratings, intertwining quality of care with financial performance. We will discuss these factors in more detail in the related blog: Why is Maintaining Medicare Star Ratings Difficult for Payers?

Enhance Ratings and Technology with Genzeon

For healthcare payers, Star Ratings are more than a benchmark for quality; they are integral to financial performance and competitive positioning.

As the healthcare industry continues to evolve towards quality and value-based care, the significance of these ratings will only grow. Insurers must therefore adopt strategic measures, including leveraging technological innovations from partners like Genzeon, to navigate the complexities of improving and sustaining high Star Ratings.

Learn more about our capabilities on our Medicare Analytics page, or contact us for more information.